Canary Warf

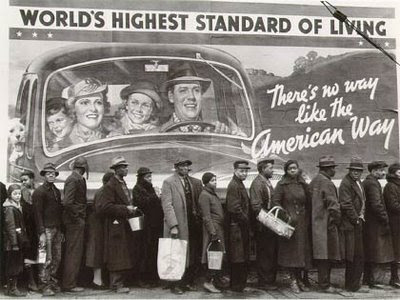

Canary WarfAccording to the Daily Telegraph, “leading City experts” (Another lot of masters of the universe?) are raising the real prospect of "Great Depression II" amid worries that the European economic crisis could trigger financial chaos.

Markets across the world have fallen to new low levels as fears surrounding the fate of the Euro transmuted into worries about the wider global economic system.

Andrew Roberts, head of European rates strategy at RBS, said "Great Depression II" could now be approaching, adding: "It now has potential to speed toward its conclusion; a European $1trn package which does little and political panic tells you we are about to reach the end of the road. The world should be discussing deflation, not inflation." Of course there are people who might question what anyone at RBS knows about anything. I’d certainly be wary about their opinion on the weather never mind an economic crisis , given their record.

, given their record.

The FTSE 100 nearly reached the 5,000 point yesterday, eventually finishing the day 5073, while the French CAC 40 index was 2.3% lower and Germany's Dax dropped 2%. The USA’s S&P 500 and the Dow Jones both suffered their sharpest one-day falls in more than a year. The S&P fell 3.9% to 1072, while the Dow closed 3.6% lower at 10,068.

These falls precipitated increases in the price of state bonds in Germany, the US and across the world with investors looking for a safe place to put their money. German 10-year bund yields fell to a record low, while in England gilt yields dropped to their lowest levels for nearly 6 months.

Although this rush for safety can be attributed originally to the Euro's difficulties this week and German Chancellor Angela Merkel’s efforts to ban short-selling on its banks, worries that the deeper economic problems may be ahead have come to light because of fresh information from the European Commission showing consumer confidence falling suggesting that the Euro zone debt crisis is now affecting consumer confidence.

Unemployment continues to rise both in Europe and in the US. This is the norm after a recession, and it had surely been anticipated. There is always a lag between the downturn ending and the stabilisation of unemployment, given that employers have so little confidence in the continued improvement in the economic situation. The deterioration in the United States’ employment picture, however, coming after last week’s drop in inflation, has increased worries that we are facing the second dip in a possible global double-dip recession.

Markets across the world have fallen to new low levels as fears surrounding the fate of the Euro transmuted into worries about the wider global economic system.

Andrew Roberts, head of European rates strategy at RBS, said "Great Depression II" could now be approaching, adding: "It now has potential to speed toward its conclusion; a European $1trn package which does little and political panic tells you we are about to reach the end of the road. The world should be discussing deflation, not inflation." Of course there are people who might question what anyone at RBS knows about anything. I’d certainly be wary about their opinion on the weather never mind an economic crisis

, given their record.

, given their record.The FTSE 100 nearly reached the 5,000 point yesterday, eventually finishing the day 5073, while the French CAC 40 index was 2.3% lower and Germany's Dax dropped 2%. The USA’s S&P 500 and the Dow Jones both suffered their sharpest one-day falls in more than a year. The S&P fell 3.9% to 1072, while the Dow closed 3.6% lower at 10,068.

These falls precipitated increases in the price of state bonds in Germany, the US and across the world with investors looking for a safe place to put their money. German 10-year bund yields fell to a record low, while in England gilt yields dropped to their lowest levels for nearly 6 months.

Although this rush for safety can be attributed originally to the Euro's difficulties this week and German Chancellor Angela Merkel’s efforts to ban short-selling on its banks, worries that the deeper economic problems may be ahead have come to light because of fresh information from the European Commission showing consumer confidence falling suggesting that the Euro zone debt crisis is now affecting consumer confidence.

Unemployment continues to rise both in Europe and in the US. This is the norm after a recession, and it had surely been anticipated. There is always a lag between the downturn ending and the stabilisation of unemployment, given that employers have so little confidence in the continued improvement in the economic situation. The deterioration in the United States’ employment picture, however, coming after last week’s drop in inflation, has increased worries that we are facing the second dip in a possible global double-dip recession.

.................

I blame George Osborne and Vince Cable.

ReplyDeleteI always wonder with story's such as these who is making loads of dosh from the volatility in the share prices.

ReplyDelete.

we must remember we are dealing with the lowest scum on the planet thieving lying scummy trash.

having planned and created one financial crisis

(and making vast amounts of cash from it).

They with their accomplices in the media will now try once again to steal some more (a second bite of the cherry.

The answer is to hang a few speculators from the lampposts in ever nation of the world then this pretendy crisis will swiftly disappear...

I don’t rate Vince Cable as some sort of financial genius who saw it all coming. He asked one relevant question of Gordon Brown in 2003 and since then has benefitted from not being in or likely to be in power and the benefits of hindsight. We will see how he does now as business secretary but my predictions are: don’t expect anything spectacular.

ReplyDeleteVince Cable continues his remarkable Transformation From Adam Smith to Mr Bean.

ReplyDeleteThe only solution is for every member-state to have to submit prospective national budgets to the European Commission for approval. Only this safety mechanism can stablise the Eurozone, and all our economic interests.

ReplyDeleteThe problem here is nation-states, the answer is liberal cooperation through binding supranational institutions - the EU.

I see the FTSE dropped below 5,000 today. We're spending £175Bn per year more than we're earning yet they expect us to bail out the lazy Greeks who retire early from non jobs ( one school in Greece had 10 gardeners and 20 teachers with only 10 pupils and no garden )

ReplyDeleteThe Germans must be mad helping to bail out Greece. It's a failed zombie state living on the money of more prudent countries. Once it has used up the 600Bn it will be back for more. Germans working until they're 65 to fund Greeks retiring at 60. Next up Spain, Portugal, Italy and then the Uk. All will need help and there will be no more money.

Best to scrap the whole corrupt project and go back to individual currencies again. It will happen eventually anyway as there's not enough money in the world to save Greece. A trading zone in Europe as per the original Common Market would be fine.

Oh and Merkel scrapping naked short selling without telling her EU partners shows how incompetent she is. It went down like a lead balloon and caused a flight of money out of euros into Swiss francs etc. Just when we needed confidence in the euro.

I reckon 12 months and everything will come to a standstill.

Year zero.

"The Germans must be mad helping to bail out Greece."

ReplyDeleteThey would be mad to stand by and do nothing.

Dean

ReplyDeleteI don't agree. We should stop now and let nation states get their countries back. Better if we had taken our hit in 2008 and let the banks fail actually. You must agree that things are going to come to a head soon. The banks are running the countries now rather than governments. How can the US with debts of $13trillion be able to give Europe $200Bn ? By printing more money and destroying the dollar of course.

All the countries bailing out Greece via the ECB and the IMF are totally bankrupt themselves. The only way things are going to end up is either a one world currency under a central one world government control. Or a total collapse ( sooner rather than later ) with individual countries starting from scratch.

We'll have to be self sufficient and switch to local bartering to survive but it's the only option apart from being a debt slave to a central world government. The islamic countries will hold out but will be obliterated in the coming attacks on their countries.

LOL @ Cowardly Lion... Spot on comment!

ReplyDelete(Nice to see you commenting here btw.....)

Dean and Anon:

ReplyDeleteI think we all realise that in this instance Greece and if necessary Spain and Portugal will have to be bailed out... and then probably thrown out of the Euro for not sticking to the Euro-rules. It seems that we can’t expect the Germans to bail them out over and over again, and it they can’t be trusted to tell the truth they will have to suffer the same fate as the UK when it couldn’t keep up the standard on the ERM back in Major’s day.

The UK won't be bailed out by Europe as it's not in the Euro, but it may well need to be bailed out by the IMF. It's happened before and it will happen again.

When it comes to irresponsibility the UK takes some beating. Half the population (women) still retires at 60, if it wishes. Add to that all civil servants are entitled to their black hole pensions at 60 and may then live on it on top of state pension for 30-40 years... and that longevity didn't happen overnight.

When you consider the size of the civil service.... wow, that's some pension bill.

It seems that every Tom Dick and Harry has a mortgage that would scare the mice, and not one, but many credit cards maxed out along with car loans and holiday loans and Christmas loans... and...well, let's say we are pretty well indebted, due to regulations being thrown to the wind in the rush for the bankers to make obscene profits, and obscene bonuses that accompany them.

We will either need to be bailed out or the 'squeezing till the pips squeak' of a previous government is going to sound like a day in the park. I imagine that retirement age may have to be put up to around 75-80, but as there are no jobs it doesn't make THAT much difference.

Anon, Tris,

ReplyDeleteWith 54% of all UK exports going to the Eurozone, it is frankly madness of a dangerous type to advocate a 'let it burn' approach. We must act to stablise our own export markets.

That said, to interpret the Greek crisis as the end of the single currency is; to my mind; mistaken. If anything the eurozone will survive with new rules and fresh controls being enacted.

The solution is not to let ourselves be governed by either banks, transnational conglomerates or indeed the increasingly irrelevant nation-state government. The answer is to further empower institutions of supranational stength. That is the only way to make order out of potential chaos, security over instability.

What was it Adous Huxley once said? "Any kind of order is better than chaos", but why settle for that? Let us forge an order which places the principals of social justice at its heart. In short a fresh order based on supranational community, as opposed to the old rhetoric of nations, wars, rivalries and chaos.

Angela Merkel is right to say "if the euro fails, Europe fails". And that shall not be allowed to happen, it would be nothing less than a return to a Europe wrecked by wars. Never.

Dean: did Greece not have to submit its books before it joined the Euro? Did it not just fiddle them and everyone was so keen to get the Euro off the ground and one big happy family they just did not look very hard or deliberately did not notice? Either that or the clever masters of the universe who set the thing up are not as clever as they think are and were hoodwinked by the Greeks. Which begs the question: what other time bombs are waiting down the line?

ReplyDeleteDean

ReplyDeleteYou seem to have missed the fact that we've tried a 'supranational community' and it has failed. The EU has failed. Through lies and corruption and debt. It was forecast years ago and has come to pass. It was tried in the USSR and failed there aswell. Individual countries can't be forced into a union that is against their natural inclinations.

40% of UK jobs rely on the EU zone but 30% of eurozone jobs rely on trading with the UK. There is nothing stopping us trading with each other outside of a political union. People will still want our exports like whisky, energy and aircraft wings etc and we will still want imports of French cheeses and wines and German cars etc.

How long will we continue to play bail out ? Every eurozone country is bankrupt so we're just printing money and passing it around. The US is bankrupt and is joining in with the eurozone as it is terrified of the EU collapsing and finishing them off aswell. Currencies will be worthless. Gold prices will rise into the stratosphere. Greece will need about £50Bn per annum to tick over. It will never pay any money back. The UK needs to borrow £10Bn a month to tick over. We're trying to inflate away our debts and devalue our currency but it's never going to work. A £6Bn reduction in our debt was the Tories political agenda during the election and labour's warning not to vote for Tory cuts. Yet this is a tiny fraction of our deficit. About 2 weeks of our annual borrowing.

People more qualified than us have been warning us for 3 years to just stop now and take the hit. Like Munguin said " what other timebombs are down the line " ?

This video explains the situation quite well. Only a couple of minutes of your time.

ReplyDeleteLaughing as you sink......

http://www.abc.net.au/news/video/2010/05/20/2905304.htm

"Oh! Brave new world that has such people in it!"

ReplyDeleteYou claim that supranationalism has been tried and died, but this is a claim which I reject utterly. The EU is central to the economic, political and social stability of Europe. Its founding principal was to forge mutual interdependence between countries which had been historic enemies and rivals. This has been an utter success.

The European Coal and Steal community saw France & Germany begin to forge a new and better chapter. In short, the EU has evolved, yes it has its faults, but it constitutes our best chance for a brave new world!

Furthermore, German and British exports are performing at their best in decades, and manufacturing is beginning to grow in importance again. What we are seeing is hardly be bancrupting of all eurozone nations, merely the transformation in economies. Back to a more mixed and balanced economic approach.

That is the best way in ensuring a strong economy for tomorrow, and the EU is central in that process. For example without EU tariff walls, British texile industry; such as it is; would disappear utterly. The EU is of increasing relevence to us all.

As for what bombs are waiting, that is a problem to overcome. Yes Italy looks risky right now- but we can use these crises as an opporunity to reform the Eurozone- to make it more "copper bottomed".

We need to reduce the independence of individual member-states to act outwith the rules and constraints of the eurozone area. To that end the member-states ought to first get budget approval from Brussels before anything else can legally happen. The problem that stands between us and supranational stability is the weak, inefficient nation-state.

Dean

ReplyDeleteOh dear. I suspect you've been on some courses. Common purpose ? EU funded degree in the EU ? Social Sciences ?

The " has been an utter success " bit was too much.

Keep smoking those green shoots of recovery.

We'll have to agree to disagree.

lol Anon, I look forward to those green shoots sooner than anyone thinks! :)

ReplyDeleteAs for my educational history, I fail to see what on earth that has got to do with anything frankly- unless your saying the EU secretly conditions school children to learn Ode to Joy off by heart? LOL

Munguin,

ReplyDeleteI mean that ever single nation budget for member-states should need to be approved by Brussels before being implimented, not just a one off- I mean perminently from now on.

Dean

ReplyDeleteYour educational and employment history has everything to do with how you see the world.

" unless your saying the EU secretly conditions school children "

Not secretly. Fully open and upfront coditioning. Which is obvious by your comments. Shall I give you some links to textbooks ? The EU policy on the climate hoax etc to be taught in schools and on the BBC ?

Anyway we'll part on good terms and I'll bookmark this page so that I may play it back to you in about 6 to 12 months.

Keep smoking those shoots buddy !

So, due to my Euro enthusiasm it is "obvious" that I am either stupid or brainwashed? What utter tripe.

ReplyDeleteDean said..

ReplyDelete" So, due to my Euro enthusiasm it is "obvious" that I am either stupid or brainwashed? "

I think it's often useful to look at the evidence before deciding which it is. Stupid or brainwashed or possibly both.

You want Brussels to approve the budgets for each member state before implementation.

This is an organisation that because of theft and endemic corruption hasn't had it's accounts signed off by auditors for 13 years. My brother is an auditor and says it's highly unusual to say the least. Criminal prosecution is the norm in the real world for such crimes. Maybe give a bit of leeway the first time but not 13 times.

Member states are bankrupt and will never be able to pay their way out of their mess. ( italy and Spain - $1trillion, Ireland $865Bn, UK £900Bn, Greece $367Bn, Portugal etc - unknown). The EU solution is to print money and give it to them to allow them to continue until the currency is worthless. No sensible or fair minded person would go to an EU shop on the High Street and ask for some advice on financial matters. They would look at their record and go somewhere else. Why would you possibly want to give them access to your countries budget and allow them to decide how 60 million people in the UK will pay their taxes etc ? That is stupid surely ?

Next up brainwashed.

Despite all the evidence of the lack of accountability and theft. Despite the calibre of EU leaders ( Kinnock, Rumpey, Ashcroft, Mandy etc ad nauseum ) . Despite member states looking after themselves when crunch came to crunch ( Germany's short selling ban, French buying up our power industries despite refusing access to their own industries, lack of support in Afghanistan, using the CAP and fishing policy as a do what you want policy). Despite the fact that countries are falling like dominoes due to debt ( while piling billions into the global warming scam ) you think it has been a great success. Only someone who has been brainwashed over several years would think that the EU was a great success and that more integration would be the answer to the problems.

In conclusion I think any unbiased and fair minded person would conclude that you're both stupid and brainwashed.

No offence.

Offence taken.

ReplyDelete"Member states are bankrupt and will never be able to pay their way out of their mess."

Nonsense, nobody has yet declared banckrupcy, and given the new Eurozone stability fund in the pipelines are unlikely do.

And Spain actually managed to hold a budget surplus before the crisis set in, and can with all market confidence return to surplus over the next decade.

German exports have never had more beneficial circumstances, and given that export and manufacture remain the primary mover in Germany, this is likely to further reinforce its own financial security more quickly than other EU member-states.

As for the UK, if Cameron-Clegg are as bold as the new coalition document explains they will be- then the UK should have reduced our budget deficit back down to managable and normal levels.

In short, your prediction that everone in the EU is "bankrupt" is factually incorrect, and as a prediction highly likely to be proven wrong. This is not to say however that banckruptcy will not happen to specific isolated examples such as Greece or potentially Italy.

"Why would you possibly want to give them access to your countries budget"

The problem here is the nation-states, who in the Greek, Italian, British, Irish etc examples have all proven that nation-states wreckless "give-a-way" budgets have brought on this crisis.

The solution is to give Brussels the power to establish an EU monetary fund, an EU stabilisation fund [comparable in role and purpose to the US Federal reserve], and to create 'lock in' mechanisms that shall prevent future Greek style spending incompetence. I.E to enable the EU institutions to scrutinise member-state budgets.

And why not? After all if the eurozone is made unstable by one nation-state, we all catch the cold. The answer is a perfectly fair, and logical liberal-institutional answer- more power to supranational institutions like the EU.

This is a matter of political theory, and my own opinions on the matter. Just because I do not happen to agree with you does not make me either "stupid" or "brainwashed".

Your opinions are not the only answer, politics is the art of tolerating other opinions and theories- without degrading them to make your own answers seem superior.

Dean,

ReplyDeleteI didn't mean to give offence. Apologies. Your utopian EU would work in an ideal world. But people are ruthless and self centred. The more power that has gone to Brussels the more instability there has been. You said " if the eurozone is made unstable by one nation-state, we all catch the cold. " This is the crux of the matter. I couldn't have put it better myself. For your own sanity don't trust the EU. They're not the answer and will lead you to oblivion. Please don't be blinkered. Read a bit more and form your own opinions. Don't let them brainwash you. You're obviously a clever bloke as you can reason and argue well. Just keep an open mind. That's all I ask of you.

I like to see a good discussion going on these blogs; I hate it when offence is given or taken.

ReplyDeleteExcellent discussion guys. It far too far above me so I won't join in. But, as far as I can see both side have much merit.

Anon,

ReplyDeleteOpen minded is certainly me. You may not realise this, but I was once a great fan of John Redwood, Tebbit and the "No, no, no" to the EU. However as I expanded my reading literature at university I experienced a change, I realised what the EU is actually about - and I loved it.

All I ask is that people do not call me stupid and foolish for happening to hold to a particularly liberal-institutionalist pro-europeanism.

Naturally I understand why it is so controversial! ;)

Well said Dean. It's really important to be able to change your mind as you absorb new facts, instead of trying to resist any fact that may disturb your view of things....

ReplyDeleteDean

ReplyDeleteFair enough. It's good we can discuss ideas without falling out.

I used to be pro EU, believed that global warming was caused by CO2, thought that there was a plan for Europe etc.

But my views have now changed. I'm an avid reader of politics and economics and have reached different conclusions to you. I did an OU course so was never in a formal class. All my studies were independent of the tutor and not influenced by her thoughts. Apart from the weekly class ( where I fell out with her for daring to question the info in the books we were given.)

All I'll say is that there's no 'stability fund'. Or any kind of plan for the EU. We really are finished. Money is being printed and sent around the EU countries in order to create the illusion of a bail out. The UK will never balance it's books. We may not declare bankruptcy. But we're bankrupt. Europe is bankrupt. The US is bankrupt. No one will stand up and say 'I'm Greece and I'm bankrupt' like in some bankrupts anonymous meeting.

Dave and Nick are going flat out to balance the books. Well they're better off not bothering. Just do an Iceland and say eff off. We're borrowing £175Bn a year just to tick over. Our debt is standing at nearly £900Bn. By 2012 it will be £1.4trillion. If Dave saves £6Bn this year then the annual deficit will reduce from £175Bn to £169Bn. It's a joke but no one is laughing apart from Gordon and his glove puppet ex chancellor Alastair Darling.

But if you're happy believing in the EU then I'm glad you have that comfort because folk like myself have no such comfort.